Aviva Wealth Builder

A Better Tomorrow

In order to build a better life for yourself &your family and to realize your dreams, you always need to plan ahead. Building your wealth requires a lot of time, dedication, and effort – but we all have to start somewhere. Whether you are buying a new home, saving for your child’s education or planning your retirement, Aviva Wealth Builder Plan can help you achieve your financial goals for all stages of life and live the life you really deserve!

Plan, build and protect your tomorrow.

Aviva Wealth Builder Policy is a traditional life insurance plan which doubles up as a valuable & beneficial financial planning tool that will help provide the maximum mileage on your investment while giving you the peace of mind. Here are some of the many features & benefits of opting for this plan:

1. Maturity Benefit

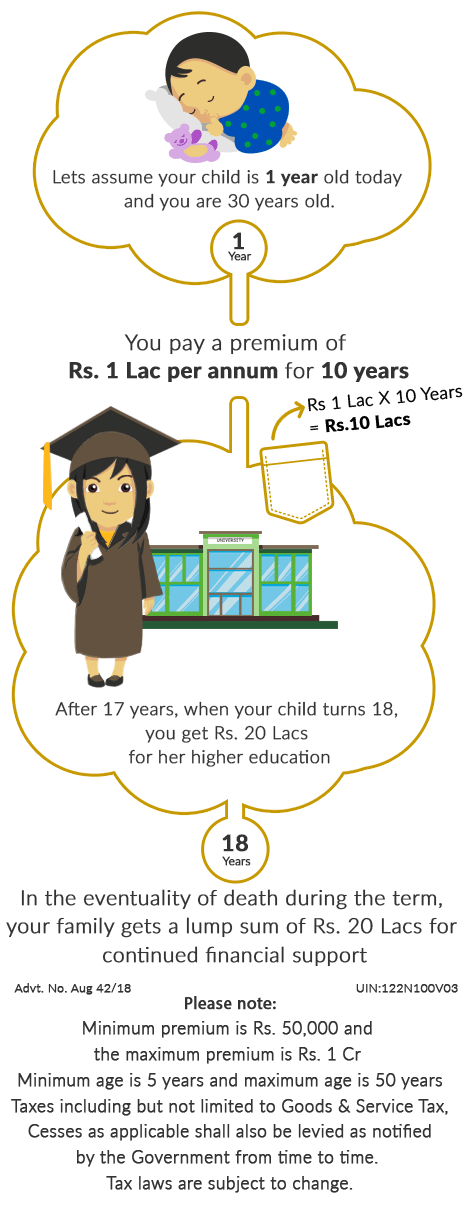

It is designed to help you build your wealth the smart way! Besides providing you with life insurance protection, this policy also provides you with the opportunity to build a tax-advantaged lump-sum to support your unique financial goals by doubling your money (double the sum of all premiums paid if all premiums are paid) for certain critical milestones in your life. This pay-out can be used to achieve any of your long-term financial objectives such as financing your child’s post-graduate education or even starting a new business venture.

2. Guaranteed protection

Often, people tend to overlook the impact of unforeseen circumstances believing that it might not happen to them. Fact of the matter is that life has several twists and turns, and for those families who are unprepared, the financial impact of such an occurrence can be devastating.

This plan helps protect what matters most – the wellbeing of your family. In case something untoward were to happen to you, your beneficiary will stand to receive an amount equal to the Sum Assured, provided all due premiums till the date of your untimely demise are paid.

For Instance:

In the event the unexpected were to happen, your debts such as housing loans, car loans, credit card debt& any student loans your kids might have taken don’t just magically disappear. The last thing you would want for during this difficult transition period is for your family to be mired into further distress. Aviva Wealth Builder plan can be your savior during these trying times by helping prepare for these expenses ahead of time. With the aid of the lump sum benefit, your family can use the money to pay off all outstanding debts while maintaining their current standard of living as well. With Aviva Wealth Builder plan –you can leave your families a little something when you pass away.

3. Tax-Exempted Income

The plancomes loaded with a wide range of tax benefits as well. Insurance premiums paid are tax-exempted under Section 80C (up to Rs. 1.5 lakh) of the Income Tax Act, 1961.Additionally, the maturity benefit from Aviva Wealth Builder Policy is non-taxable as per Section 10(10D) Income Tax Act, 1961. So the lump sum amount received by your family will be a good wholesome amount without any tax deduction.

4. Flexibility

It offers choices when it comes to choosing premium payment and policy terms. It allows you to select a premium amount, as per your comfort & convenience, which can help build the corpus you need to meet your financial goals.

Do not delay in taking control of your wealth-building because the reality is that the sooner you take charge; the sooner you can work towards achieving better results for your future. Aviva Wealth Builder can do the heavy lifting on your behalf and help meet your retirement, lifestyle and long-term financial goals!

- Admission to the dream college, start up funds for the dream business

- Flexibility to choose policy terms according to your child’s lifestage need

- The guaranteed* double of premiums shall be paid to the family even in your absence, your child’s future is protected