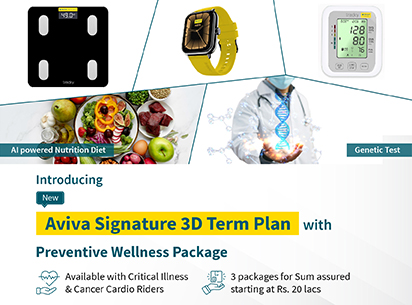

Aviva Life Insurance Riders

Enhance Your Coverage with Riders

At Aviva Life Insurance, we understand that life is full of uncertainties, and it's crucial to safeguard your loved ones and yourself against unforeseen events. That's why we offer a range of riders to complement your life insurance policy, providing additional protection and benefits tailored to your needs.

What are Riders?

Riders are additional benefits that policyholders can add to their base life insurance policies to customize coverage according to their specific requirements. These riders offer extra protection beyond the basic death benefit, providing financial security in various scenarios such as critical illness, disability, accidental death, and more.

Benefits Of Riders

Customized Protection: Riders allow you to tailor your life insurance policy to match your unique needs and circumstances. Whether you're concerned about medical expenses due to a critical illness or want to ensure your family's financial stability in case of disability, riders offer personalized coverage options.

Enhanced Financial Security: By adding riders to your life insurance policy, you can enhance your financial security by addressing potential risks that may not be covered by the base policy alone. This ensures comprehensive protection for you and your loved ones, giving you peace of mind knowing that you're prepared for life's uncertainties.

Affordability: Riders often come at an additional cost, but they can be highly cost-effective compared to purchasing separate insurance policies for specific risks. Aviva Life Insurance offers competitive rates for riders, making it easier for you to access comprehensive coverage without breaking the bank.

Flexibility and Convenience: With Aviva Life Insurance, you have the flexibility to choose from a variety of riders based on your individual needs and preferences. Whether you're looking for long-term disability coverage, critical illness benefits, or accidental death protection, our range of riders ensures that you can tailor your policy to suit your lifestyle and priorities.

Tax benefits: Opting for riders enables you to avail applicable tax benefits on the premiums paid and the benefits received. Tax benefits are as applicable tax laws subject to change.

Riders Available with Aviva

Aviva Life Insurance offers a range of riders including critical illness rider, accidental death benefit rider, and more. These riders provide additional protection and benefits beyond the basic life insurance coverage.

-

Aviva Group New Critical Illness Non-Linked Rider(122B038V02)

-

Aviva Group Accidental Death Benefit Non-Linked Rider(122B039V01)

-

Aviva Group Accidental Total & Permanent Disability Non-Linked Rider(122B040V01)

Conclusion: Riders play a vital role in enhancing your life insurance coverage, offering personalized protection against various risks and uncertainties. With Aviva Life Insurance, you can customize your policy with a range of riders to suit your individual needs and priorities, ensuring comprehensive financial security for you and your family. Explore our rider options today and take the first step towards a more secure future.

No you can not add riders to your existing Aviva Life Insurance policy. You need to opt for the riders at the time of purchase of the base plan. You can opt for as many riders you want subject to the terms and conditions of the base policy.

Yes, riders typically come at an additional cost beyond the base premium of your life insurance policy. However, the cost of riders is usually affordable compared to the benefits they provide, offering valuable protection against various risks and uncertainties.

Yes, riders can be highly beneficial for policyholders seeking comprehensive protection against specific risks such as critical illness, disability, accidental death, etc. By adding riders to your life insurance policy, you can customize your coverage and ensure greater financial security for yourself and your loved ones.

AN May 11/24

:

:  :

: